How to buy a house for first-time buyers

Calling all first-time buyers...

If you’re ready to buy a house and take that all important first step on the property ladder, then this one’s for you. Maybe you want to start viewing properties, but don't know what you can afford? Have you got your decision in principle ready for when you want to make an offer? Have you budgeted for stamp duty and solicitor fees?

Luckily, you’re in the right place. We’ve put together a simple guide to buying your first home so that you know what’s what and are ready and raring to go.

Step 1) What can you afford?

Lots of first-time buyers are so focused on saving enough for a deposit, they forget about all the additional costs – like surveys, stamp duty, and solicitor fees. Then there’s buildings insurance and life insurance so that you can retain the ability to pay your mortgage, even if the worst should happen.

While there are some simple guidelines for working out what you could borrow (and you can use our free mortgage borrowing calculator for this), there are no hard and fast rules. Each case is unique, and lenders will consider your salary, expenses, any debts, your credit history, and more when reviewing an application. Speak to a qualified independent mortgage adviser to get an accurate idea.

Step 2) Get a decision in principle

When you make an offer on a property, you’ll be asked to supply your decision in principle. This is a document that says a mortgage lender is happy to supply you with a mortgage for a certain amount based on the information you’ve supplied. It’s a great idea to get this in place now so that as soon as you want to put an offer in you’ve got all your ducks in a row.

This is something your mortgage adviser will be able to sort out for you.

Step 3) House hunting

This stage is self-explanatory. Armed with your decision in principle and a good understanding of your budget, you can (try to) enjoy the process.

Step 4) Offer accepted

Congratulations! Your offer has been accepted. Except it’s a very long journey from here to completion, with a lot of potential for it all to fall through. Not to worry you...

Now that your offer’s been accepted, you’ll need to submit your mortgage application to your chosen lender. It’s important to know that you don’t have to go with the lender who supplied your decision in principle. Now that you know the purchase price of the house, you’ll want to secure the best deal possible with the best rates. As fully independent mortgage advisers, we have access to the full range of lenders, and can often get exclusive deals not available on the high street.

You’ll have to get a survey at this point too. Surveys range from a basic home condition survey costing around £250 to a full structural survey from £600 or more. Spending more on this can save you money in the long run as it’ll identify any issues with the property that could cost you a fortune if ignored. Your mortgage adviser can provide details of the different types of surveys available and what elements of the house they cover.

Step 5) Exchanging, completing, and all the expenses you (hopefully) budgeted for...

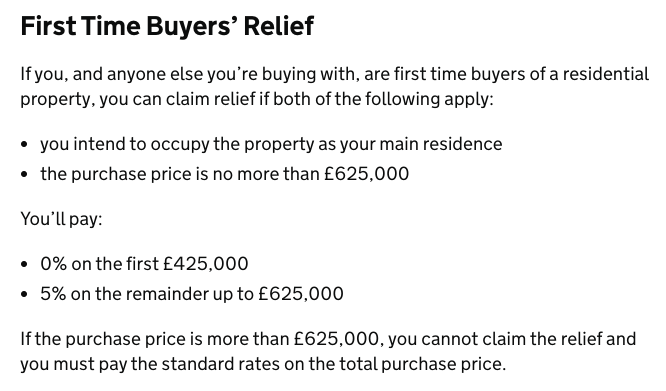

Conveyancing fees (the legal costs of buying a house) are roughly between £300 - £1500, usually linked to the value of the property. Stamp duty costs also depend on the price of the house, but there’s some relief for first time buyers as detailed below:

You won't be able to get your mortgage without arranging buildings insurance to cover the structure of your new home, so you’ll have to include the monthly cost of that in your budget. It’s also a good idea to sort life insurance and critical illness cover to retain the ability to pay the mortgage should the worst happen.

When your protection policies are in place and your mortgage is sorted, you’ll be in a position to complete the purchase. First, you’ll exchange which is when the house deposit is due, and then on completion the conveyancing fees and stamp duty will need to be paid. It’s an expensive time – you've bought a house!

So, what’s next?

It’s a lot to think about. Simplify the process with expert guidance. When you work with us, we’ll be able to take on most of the legwork for you, like securing the best deal possible for your individual circumstances and arranging all the protection policies you’ll need.

Get in touch today to book your free initial consultation, and let’s get you moving.